Tap into My Equity(https://tapintomyequity.ca/) is a company that I would highly recommend freelancers avoid at all costs. My experience with this company has been incredibly negative, and I feel compelled to share my story to warn others. I completed a project for Tap into My Equity, and despite several attempts to contact the company for payment, I have yet to receive any compensation for my services. The lack of professionalism and disregard for timely payment has left me feeling undervalued and disrespected as a freelancer.

The dream of homeownership typically comes bundled with the strategy of creating fairness. It really is that perception of accumulating wealth in your own personal partitions, a expanding nest egg represented because of the increasing worth of your assets. But what if you might unlock that potential, change that fairness into usable resources? That's in which the concept of tapping into your private home fairness comes in.

You'll find a multitude of explanation why a homeowner could possibly think about this feature. Possibly an unpredicted expenditure has reared its head, a medical bill or perhaps a essential property repair service that throws a wrench into your economical plans. Perhaps you have been eyeing a desire renovation, a person that could add substantial value to your home while improving your Standard of living. Or possibly financial debt consolidation may be the aim, streamlining numerous high-desire debts into one, far more manageable personal loan.

Regardless of the purpose, comprehending how to faucet into your house fairness is critical. The good news is, there are actually proven monetary applications at your disposal, Every single with its personal pros and issues. Let us delve into the most typical solutions:

**The Home Fairness Loan:** Generally known as a 2nd home loan, a home fairness loan lets you borrow a hard and fast sum of money depending on the appraised price of your home and the quantity of fairness you've got built up. This equity is usually the difference between your private home's current industry price and what you continue to owe on the existing mortgage loan. After authorised, you get a lump sum payment that you simply then repay above a set phrase, commonly concerning 5 and 30 yrs, with a hard and fast desire level.

This selection can be a good match for those who require a clear, described amount of cash upfront for a certain function. The mounted curiosity charge provides predictability within your month-to-month payments, and because it is a independent mortgage from your mortgage, it would not impression your current home loan conditions (assuming you secured a good price initially). On the other hand, it is important to do not forget that you're incorporating An additional personal debt obligation along with your present house loan, so cautious budgeting is critical.

**The Home Fairness Line of Credit (HELOC):** This feature capabilities a lot more similar to a credit card secured by your own home equity. After approved, you are specified a credit score Restrict that you can accessibility on an as-wanted foundation. Picture a revolving line of credit rating, in which you only spend curiosity on the quantity you borrow. This adaptability can be eye-catching, specifically for ongoing jobs or sudden bills.

You can find often a draw time period using a HELOC, a set timeframe where you can accessibility the cash freely, with least payments ordinarily centered on desire only. Following that attract period of time finishes, you enter a repayment period in which your bare minimum payments will enhance to include principal combined with the curiosity. The variable curiosity price on a HELOC could be a double-edged sword. Whilst it might be lower than a hard and fast-level personal loan to begin with, it Tap into My Equity could possibly fluctuate after some time, perhaps impacting your regular monthly payments.

**The Funds-Out Refinance:** This option involves refinancing your present house loan for a greater quantity than Anything you at this time owe. You pocket the real difference as money, essentially utilizing your constructed-up fairness. For example your home's price has elevated significantly, and you've got compensated down a substantial percentage of your authentic property finance loan. A funds-out refinance allows you to faucet into that increased worth and utilize the funds for a variety of purposes.

The advantage of a dollars-out refinance is that you could most likely secure a reduced fascination rate than your existing home finance loan, particularly when interest charges have dropped because you to start with bought your property. This may lead to significant cost savings about the long run. Having said that, it's important to do not forget that you are extending the repayment expression on your own home finance loan, likely introducing years to your loan. In addition, some lenders have restrictions on just how much money you may take out through a cash-out refinance.

Tapping into your home fairness might be a strong monetary tool, but it's not a call to get taken frivolously. Prior to embarking on this route, thoroughly look at your motives for needing the funds. Can it be a needed expense, a strategic investment, or A brief Answer? Remember, you happen to be putting your own home on the line, so dependable use in the borrowed resources is paramount.

Consulting using a financial advisor is often invaluable. They may help you assess your fiscal situation, assess the different possibilities accessible, and tutorial you towards the best suited system for tapping into your house equity. Try to remember, a effectively-educated decision can unlock the likely in just your walls and empower you to attain your money plans.

Danny Tamberelli Then & Now!

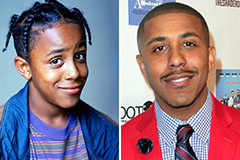

Danny Tamberelli Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!